For any investor who wishes to enter the stock markets, understanding their investments is of the utmost importance. There are three categories of stocks – small cap, mid cap and large cap stocks which you should learn more about here. Read further in this article below!

Definition and Characteristic

Large-cap stocks can be defined as stocks with market capitalization exceeding Rs 20000 crore that have established businesses with steady revenues and earnings that have established themselves over time. Because market leaders also generate substantial revenues, their share price fluctuations often have more of an effect than others on overall market fluctuations.

Mid-cap stocks are defined as companies with market caps between Rs 5000 crore and Rs 20,000 crore, offering greater risk profiles and growth potential than larger cap firms. Small-cap stocks, defined as those with market values under Rs5000 crore, often represent businesses and start-ups that have yet to prove viability.

Small cap stocks provide tremendous growth potential but also pose greater risks than large and mid cap stocks due to being emerging businesses which may experience rapid expansion or go bankrupt quickly, thus before investing in small cap stocks, proper due diligence should be performed and balanced asset allocation and diversification should be applied when making decisions regarding allocation and diversification of assets should occur.

Relying too heavily on one category increases portfolio volatility as different tiers may react differently to changes and economic conditions; large cap stocks were most affected during this economic slowdown while smaller caps experienced greater share price drops than their larger counterparts; diversifying with small cap sectors nonetheless may help you meet long-term investment goals more easily.

Performance and Volatility

Small-Cap Investors In general, small and mid cap stocks offer greater potential returns than larger caps; however, due to greater levels of volatility they require investors to have greater risk tolerance when investing. Small firms tend to offer greater growth potential and profitability compared to their larger counterparts; however, many lack cash reserves or brand recognition of blue chip firms. Before investing in such categories, it is imperative that an appropriate level of risk tolerance and investment horizon have been established prior to taking such decisions.

Large-cap companies typically enjoy robust business cycles with steady revenues and profits, often becoming dominant players within their respective industries, leading to widespread consumer recognition of brands across the nation. Small and stable companies tend to adapt quickly to changing market conditions; news about them frequently receives widespread coverage in the media.

Investors with moderate to high risk tolerances typically invest in large-cap stocks, which offer greater stability and less volatility than smaller cap stocks. A “large cap” stock refers to stocks worth $10 billion or more; mega cap stocks may also fall under this category.

Mid-cap stocks with market values between $2 billion and $10 billion encompass a diverse group of businesses. They may include emerging businesses that are just getting started in their industries; or established firms who may experience growth setback in future years.

Large-cap companies tend to be more experienced than their smaller counterparts and tend to reinvest earnings back into operations rather than disburse dividends, thus helping ensure long-term growth and profitability. Small businesses tend to rely less heavily on debt markets for financing and possess liquid assets (such as stocks, cash reserves, property assets or merchandise) which they can draw upon during economic downturns.

Midcap stocks tend to be less volatile than small-caps, providing reliable long-term performance potential. Unfortunately, midcaps may become more vulnerable during economic downturns, making fundraising challenging in these situations.

Investment Considerations

No matter your level of experience or investment goals, it is vital that you understand the differences among large cap, mid cap, and small cap stocks as each type can offer unique advantages and risks.

Large-cap stocks tend to be more secure and provide investors with higher returns, including dividends that provide a steady source of income for them. Established companies with significant cash flows and capital can have established histories of success; market leaders may even become household names – further increasing stability.

Mid-cap stocks provide investors with an excellent way to diversify their portfolio while still seeking growth potential. Mid-caps tend to experience faster growth rates and returns than large caps but with reduced volatility than small caps – offering reliable income sources for investors.

Small-cap stocks hold tremendous growth potential as these early stage companies often take more steps toward expansion than larger corporations. Small-cap stocks often carry greater risks and experience more volatility; additionally, these stocks typically receive less analyst coverage and research time and thus become underpriced in the market.

Small-cap stocks can be easily acquired and traded online through brokers or advisors; however, investors often prefer funds that specialize in them due to their ease of acquisition, diversification benefits, and lower fees. Specialized funds possess the expertise to identify niche sectors or geographic niches which generalist funds may overlook. When selecting large, mid, or small cap stocks it is crucial to take your goals, risk tolerance, and market trends into consideration when making your selection decision.

Each type of stock offers distinct strengths and characteristics; depending on which ones best meet your investment goals, large cap stocks could provide more security while mid cap or small cap shares could offer higher growth potential. Diversifying across markets helps investors mitigate risk while increasing return-on-risk profiles overall.

Market Dynamics and Trends

An investor’s choice of large cap, mid cap or small cap stocks depends on several variables including their risk tolerance and investment horizon. Large cap companies tend to operate within established industries, making their stocks less susceptible to volatile price swings than those from emerging companies; however, larger caps may take longer responding to economic cycles, potentially leading to underperformance during certain times of economic cycles.

Mid-cap and small-cap stocks often offer significant growth potential that can deliver long-term gains to investors, particularly if their companies expand their market presence or develop innovative products in response to emerging trends. However, investing in these securities may be riskier due to increased exposure to economic cycles that directly impact them more directly than with larger cap stocks.

Mid-cap stocks offer investors with moderate risk tolerance an attractive return and stability. Mid-cap companies tend to have more established business models than small cap ones while still possessing growth potential and less volatility than larger caps. Furthermore, mid cap firms may find it easier accessing capital markets as their businesses develop and mature.

Small-cap stocks tend to be more volatile than their larger-cap counterparts due to being more speculative and operating in emerging industries; therefore becoming more exposed to economic cycles than larger firms and experiencing higher turnover rates. Small-cap stocks could outshone large and mid-cap stocks when it comes to market share gains; provided the firm offers superior products or services and successfully innovates them over time.

Large-cap stocks tend to offer greater liquidity as they are popular among investors, whereas mid and small-cap stocks often possess lower or moderate liquidity with wider bid/ask spreads and increased trading costs; this may make rebalancing your portfolio difficult quickly for active traders, while investors who struggle to sell shares at current market price may experience difficulty quickly selling positions if necessary.

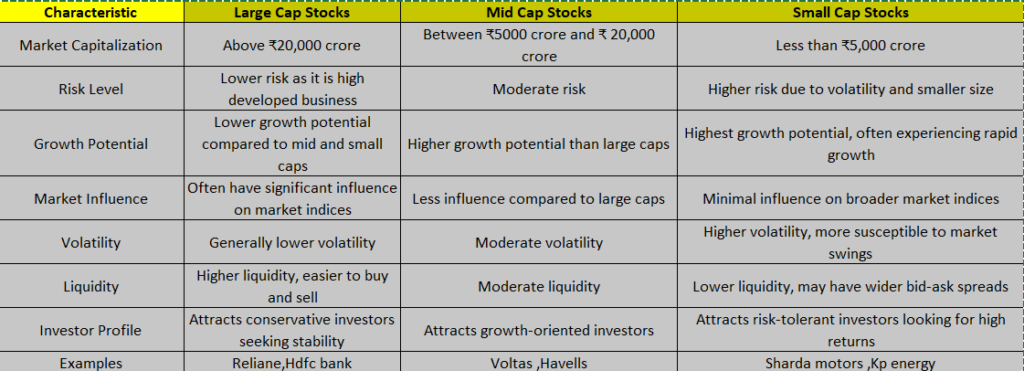

Tabular comparison of Small cap, Mid cap and large caps stocks