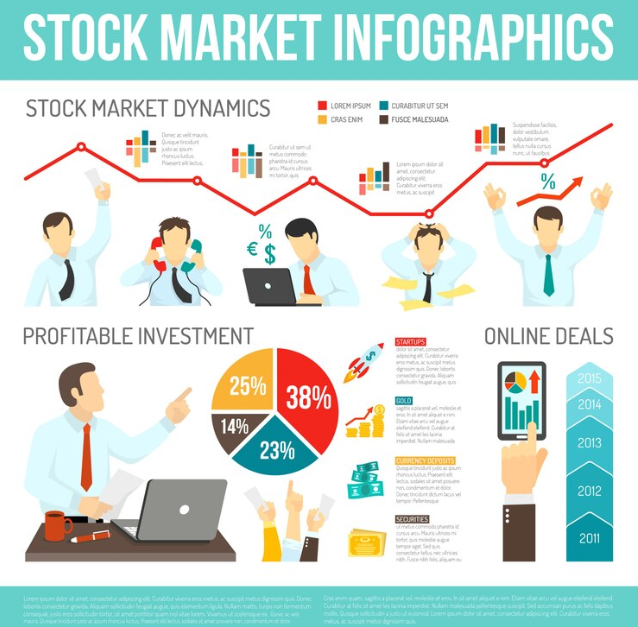

Investing can be one of the most efficient methods of long-term wealth creation; yet its alphabet soup of terms and constant news updates about market movements may seem intimidating at first. Here is an introduction into investing basics which should make investing simpler: A Beginner’s Guide for Understanding Investments. Stock markets don’t need to be intimidating or confusing. By learning the fundamentals, investing can start immediately.

Basic Information

Stocks (sometimes referred to as equities) are securities which represent partial ownership in a public company and issued to raise capital or expand businesses while investors who purchase these can reap dividends or capital appreciation as returns for ownership.

Understanding how markets function is integral to becoming an experienced investor, especially for newcomers who should prioritize long-term investing with diversification as their top goal. We can learn about investing and trading via YouTube and many books are available on internet in today’s era to learn about stock market in details. Th best strategy to learn about stock market is trial and error technique.

Stock trading may seem intimidating at first, but many online brokers now provide accounts with low or no minimum requirements and commission-free trading that make starting out easier even with limited funds.

Starter investors must familiarize themselves with various stocks, how they trade and reading charts. Basic investing concepts include open, high, low and previous close prices – these indicate when stocks trade within regular market hours.

TYPES

A stock market is an online trading marketplace where investors can exchange shares. It provides businesses with equity capital while giving investors an interest in its profits through dividends or capital appreciation.

Step one of investing is organizing your finances. Understanding all aspects of your income, expenses, savings and any debt can help determine if there’s sufficient funds available for investing. Speak with trading experts or read financial news reports regarding stock markets to broaden your knowledge about them and increase investment returns. Try to save and invest at least 10% of your monthly income on regular basis.

Stocks are ownership shares in public corporations that give shareholders voting rights and an ownership claim on net assets and future earnings of that business. Both individual investors and institutional investors use stock exchanges to buy and sell these securities on the open market where prices depend upon supply and demand – novice investors should focus on blue-chip stocks with long histories as starting points to their investing journeys as they are very safe investments. The safer the investments the less we will get return.

COMPANIES

Companies Businesses require funding in order to grow and operate, often more than can be raised solely from selling goods and services. Some firms opt to list shares of their company on the stock market for sale – offering dividends or increasing its stock price as ways of profiting from issuing equity (also called stock).

These companies trade on stock exchanges, which connect buyers and sellers of stocks. An auction system determines prices according to supply and demand. Stock trading can be more complex than shopping on Craigslist; therefore, it’s essential for investors to conduct thorough research before beginning this venture. Before undertaking their journey, it would also be prudent for them to gain an understanding of all forms of investments available and their functions

Regulations

Investors and traders purchasing and trading shares must abide by various stock market regulations in order to keep markets stable, promote transparency, and avoid fraud; self-regulation as well as government regulations can both have advantages; for maximum accountability it would be wise for investors and traders to utilize both methods when possible.

Stocks give investors partial ownership in publicly-traded companies and serve as an effective method for them to raise capital and expand their businesses. Ownership can bring dividend payments or capital appreciation; investing can be an excellent way to build wealth over time; however, it’s essential that before diving in that you gain enough knowledge of how markets function so as to avoid costly errors and make informed choices.

TAXES

A fundamental aspect of stock market basics includes understanding how taxes influence company profitability, dividend payments to shareholders and stock prices. Investors can reduce taxes through investing in tax-exempt retirement accounts or tax loss harvesting strategies to lower their overall tax bill.

The stock market provides private businesses an avenue to raise capital from investors through offering shares of ownership on an exchange, where supply and demand determine each share’s price. Stock market is the best way for any company to raise the funds because if they try to raise the funds from bank then they will have to pay huge interest to the bank which will affect the profitability of the company.

Investment can lead to long-term wealth creation; however, successful investing requires disciplined saving and an all-or-nothing strategy. A financial plan which takes your goals, risk tolerance, time investment commitment and time invested into account is integral for its success; review your plan regularly as your life changes.

Trading stocks is an efficient and proven means of building wealth over time, but before diving in it’s important that investors gain a full understanding of how the market functions and why prices may rise and fall over time. This article covers all of these basics as well as why stocks fluctuate up or down in value.

Stocks are commonly traded through exchanges such as the New York Stock Exchange and Nasdaq in USA and NSE and BSE are common exhanges in india, which act like all-in-one swap meets, auction houses and shopping malls combined – prices determined by supply and demand in similar ways as auction houses would do. Opening a brokerage account today is easy – all it requires is providing personal data, meeting minimum investment requirements and finding an account broker who matches up perfectly to your trading style and goals before funding and beginning trading! Maintaining regular portfolio reviews while following long-term plans and diversifying are integral parts of becoming an efficient investor

If you wish to earn more from trading or if you want to have a diversified portfolio then try learning Forex trading .